Plymouth is located in the southwest of England, on the coast of Devon. It’s a historic town with a long maritime tradition, dating back to the time when it was founded by the Romans. Over the centuries, Plymouth has been home to many different cultures and communities, all of which have left their mark on the town.

Today, Plymouth is a vibrant and diverse town, with something to offer everyone.

Whether you’re looking for a first-time buyer mortgage, a holiday cottage mortgage, or any other type of mortgage, a Plymouth broker can help.

What is the housing market in Plymouth like?

Plymouth is a popular place to live, and as such, the housing market is quite competitive. However, there are still good deals to be had, especially if you’re prepared to do your research.

There are a variety of different types of property available in Plymouth, from traditional terraced houses to modern apartments. There’s something to suit every taste and budget.

If you’re thinking of buying a property in Plymouth, it’s a good idea to speak to a local mortgage adviser before committing yourself to a property. They’ll be able to give you advice on the best type of mortgage for your needs, explain the mortgage repayments and guide you through the process of applying for one.

Respect Mortgages works with one of the largest and most respected independent mortgage brokers. They have been in business for over 45 years and have qualified advisers all over the UK, including Plymouth.

What does a mortgage broker do?

A broker is someone who helps people to find the best mortgage deals. They’ll work with you to understand your financial situation and your property-buying needs, and then they’ll search the market for the best deals on offer.

A good mortgage broker will have a wide range of contacts within the industry, which means they’ll be able to find you deals that you may not be able to find yourself. They’ll also be able to guide you through the process of applying for a mortgage, making it as stress-free as possible.

Why would you need a mortgage broker?

There are a number of reasons why you might need the services of a mortgage broker.

If you’re a first-time buyer, you may not be familiar with the process of applying for a mortgage. A broker can guide you through each step, from finding the right deal to filling out the necessary paperwork.

If you’re looking to remortgage your property, a broker can help you to find a better deal than the one you’re currently on. They’ll also be able to negotiate with your current lender on your behalf, which could save you a considerable amount of money.

If you’re self-employed, you may find it difficult to get a mortgage from a high street lender. A mortgage broker will be able to find you a specialist self-employed mortgage that meets your needs.

If you live in Plymouth there’s a high probability that you are employed on a ship. If so, then a seafarer mortgage could be just what you need.

What types of mortgage can a broker deal with?

Mortgage brokers are able to deal with a wide range of different types of mortgage, including:

- First-time buyer mortgages

- Buy-to-let mortgages

- Remortgages

- Self-employed mortgages

- Bad credit mortgages

There are many more different types of mortgage available.

Are brokers qualified?

All mortgage brokers in the UK must be qualified to give financial advice. This means that they have completed a recognised financial qualification, such as the CeMAP (Certificate in Mortgage Advice and Practice).

In order to give you the best possible advice, your broker should also keep up to date with changes in the mortgage market.

How to find a broker in Plymouth

If you’re looking for mortgage advice in Plymouth, there are a few different ways to find this.

The best way to find a good broker is to ask family and friends for recommendations. If you know someone who has recently bought a property, they may be able to put you in touch with their broker.

Another option is to search online for mortgage brokers in Plymouth. This will give you a list of all the brokers in the area, which you can then research to find the best one for your needs.

Or you could contact Respect Mortgages and let us introduce you to a fully qualified whole of market adviser.

A wide range of mortgage options

LOOKING AFTER YOUR BORROWING NEEDS

Buy to let

Competitive buy to let mortgages that include options for SPV borrowing, purchase, remortgage or capital raise.

Holiday Let

Specialist advice for UK holiday let mortgages including Furnished Holiday Lets, Airbnb and mixed use properties. Solutions for purchase, remortgage and develop.

Moving Home

Take the stress out of finding a moving home mortgage by letting our brokers arrange that for you.

Second Homes

A second home mortgage will allow you to purchase a UK holiday home for you and your family to enjoy.

Remortgages

Time to remortgage? Switch your mortgage to a new lender and grab yourself a new interest rate at the same time.

First Time Buyer

All the help you need getting onto the property ladder and buying your first home. Including a cracking mortgage deal, sourced just for you.

Equity Release

An equity release lifetime mortgage can provide a tax-free lump sum or ongoing sums of money that you can spend however you wish.

Specialist Mortgages

Multiple streams of income, employment status, size of mortgage or perhaps an unusual property? Let’s get to work…

Mortgage Guides

Our mortgage guides will help you understand and compare different mortgage products whether you’re starting out, moving, remortgaging or buying to let.

Insurance

Making sure you, your home and your mortgage are protected against the unexpected.

Mortgage Calculators

Our easy to use mortgage calculators can help you at every stage of your mortgage journey. From working out what you could borrow to calculating the Stamp Duty.

SPV Mortgages

Rather than buying an investment property in their own name, many investors are now choosing to do this through a Special Purpose Vehicle limited company, or SPV.

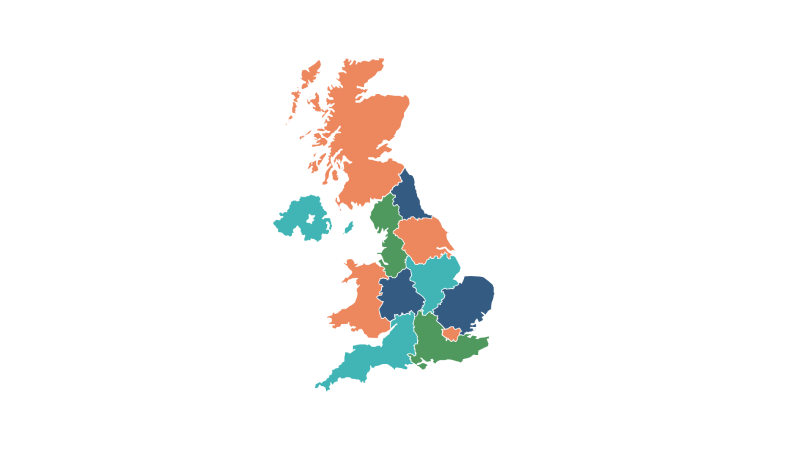

Other areas covered: