Selsdon is a district located in the south of Croydon, England. It is situated between Purley and Addington, and is bordered by Coulsdon to the north, Sanderstead to the east and Warlingham to the west. The district takes its name from Selsdon Wood, an ancient woodland that once occupied the whole area.

As well as bordering greenbelt countryside Selsdon has great transport links, with easy access to London & the South Coast, and is close to many local and national attractions.

The earliest written records, dating to the Anglo Saxon period, show that Selsdon was owned and used as a manor, farm and hunting venue by the monarchy and for a long time loaned/leased to Religious Orders such as the Benedictines. It is said that a tree in the grounds of the now Selsdon Park was planted by Queen Elizabeth 1.

Selsdon was originally a small village located within the parish of Croydon in Surrey. The village began to grow in the late 19th century, when wealthy Londoners built large country houses in the area.

During the 20th century, Selsdon continued to grow and develop, with new housing being built to accommodate the growing population. In the 1960s, Selsdon was designated as a London borough, and in 1965 it became part of the Greater London area.

Property in Selsdon

The property in Selsdon is very mixed with lots of flats, semi’s and detached properties, many of these being built during the 1960’s. There are also a number of flats and townhouses within the Forestdale area and both places are very popular with first time buyers.

Moving slightly further afield gives you larger detached properties in Sanderstead, Shirley and Warlingham.

Will I need a mortgage broker?

If you are looking to purchase property in Selsdon, you may need the help of a mortgage broker. A mortgage broker can help you to find the best mortgage deal to suit your needs and circumstances.

Respect Mortgages works with one of the largest and most respected independent mortgage brokers. They have been in business for over 45 years and have qualified advisers all over the UK, including Selsdon and South Croydon.

What types of broker are there?

There are two main types of mortgage broker: whole-of-market and restricted.

A whole-of-market mortgage broker will have access to the entire range of mortgage deals available from all lenders. This means that they can find the best deal to suit your needs and circumstances.

A restricted mortgage broker only has access to a limited range of mortgage deals from a small number of lenders. This means that they may not be able to find the best deal to suit your needs and circumstances.

What does “whole of market” mean?

When dealing with a whole of market broker or independent mortgage broker, you will have access to the whole of the mortgage market. These brokers will trawl through the different lenders and deals to pick out the ones they feel best suit you.

Most brokers of this type will have access to around 90 lenders.

What types of mortgage borrowers can a broker deal with?

Mortgage brokers can deal with a wide range of borrowers, including first-time buyers, home movers, buy-to-let investors and those looking to remortgage.

Why would anyone use a broker?

There are a number of reasons why you might choose to use a mortgage broker, including:

- You don’t have time to trawl through the entire mortgage market yourself

- You want someone who can provide impartial advice

- You’re not sure which type of mortgage is right for you

- You want to compare deals from different lenders

- You want to find a mortgage with specific features or terms

A wide range of mortgage options

LOOKING AFTER YOUR BORROWING NEEDS

Buy to let

Competitive buy to let mortgages that include options for SPV borrowing, purchase, remortgage or capital raise.

Holiday Let

Specialist advice for UK holiday let mortgages including Furnished Holiday Lets, Airbnb and mixed use properties. Solutions for purchase, remortgage and develop.

Moving Home

Take the stress out of finding a moving home mortgage by letting our brokers arrange that for you.

Second Homes

A second home mortgage will allow you to purchase a UK holiday home for you and your family to enjoy.

Remortgages

Time to remortgage? Switch your mortgage to a new lender and grab yourself a new interest rate at the same time.

Right to Buy

If you are a local authority tenant and want to buy the property you’re living in using the Right to Buy scheme, we can help you find the best mortgage deal.

Guarantor / JBSP

If you are struggling to qualify for the mortgage you need, or don’t have enough deposit, then perhaps a guarantor mortgage could help.

First Time Buyer

All the help you need getting onto the property ladder and buying your first home. Including a cracking mortgage deal, sourced just for you.

Equity Release

An equity release lifetime mortgage can provide a tax-free lump sum or ongoing sums of money that you can spend however you wish.

Specialist Mortgages

Multiple streams of income, employment status, size of mortgage or perhaps an unusual property? Let’s get to work…

Mortgage Guides

Our mortgage guides will help you understand and compare different mortgage products whether you’re starting out, moving, remortgaging or buying to let.

Insurance

Making sure you, your home and your mortgage are protected against the unexpected.

Mortgage Calculators

Our easy to use mortgage calculators can help you at every stage of your mortgage journey. From working out what you could borrow to calculating the Stamp Duty.

SPV Mortgages

Rather than buying an investment property in their own name, many investors are now choosing to do this through a Special Purpose Vehicle limited company, or SPV.

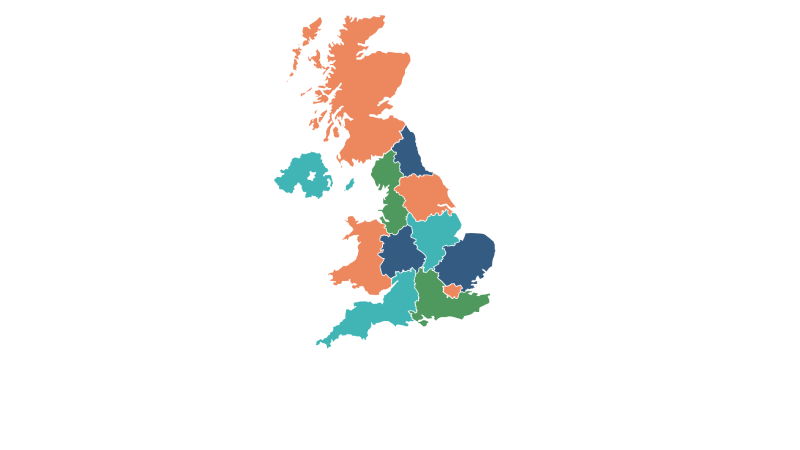

Other areas covered: