Poole is a place located in the south of England. It is a popular tourist destination, thanks to its lovely coastline and beaches. Poole also has a rich history, which can be explored at various points in the town. There are plenty of places to eat and drink in Poole, as well as shops and other amenities.

Poole is the perfect place to enjoy a UK seaside break. With its stunning coastline, lovely beaches and rich history, Poole has something for everyone.

Many of these reasons are why so many people choose to buy a house there to set up home. It’s not just a place for holidaymakers but somewhere people want to live long term too

Poole offers a great work-life balance with plenty of opportunities to enjoy the outdoors, whether that’s taking a stroll along the beach or exploring one of the many scenic walking and cycling routes.

Property in Poole

The property is varied, from traditional seaside bungalows to large executive homes, and there’s something to suit all budgets.

Poole’s location is also desirable, being just a short drive from Bournemouth and close to the New Forest National Park.

Will I need a mortgage broker?

If you are looking to purchase property in Poole, you may need the help of a mortgage broker. A mortgage broker can help you to find the best mortgage deal to suit your needs and circumstances.

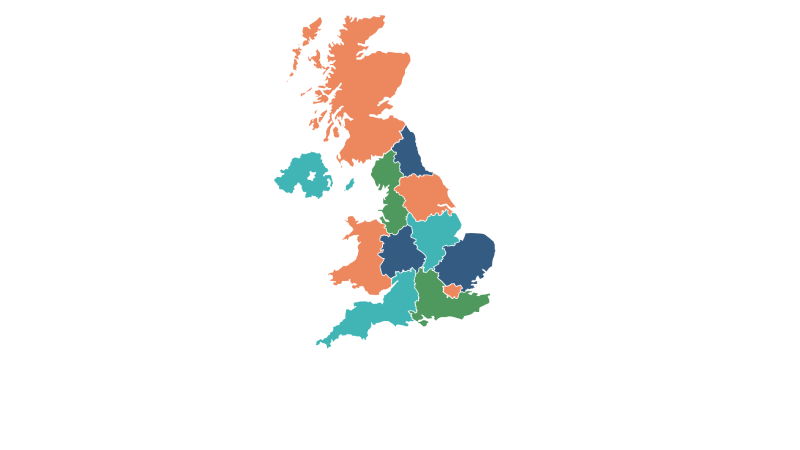

Respect Mortgages works with one of the largest and most respected independent mortgage brokers. They have been in business for over 45 years and have qualified advisers all over the UK, including Poole and nearby Bournemouth.

What types of broker are there?

There are two main types of mortgage broker: whole-of-market and restricted.

A whole-of-market mortgage broker will have access to the entire range of mortgage deals available from all lenders. This means that they can find the best deal to suit your needs and circumstances.

A restricted mortgage broker only has access to a limited range of mortgage deals from a small panel of lenders. This means that they may not be able to find the best deal to suit your needs and circumstances.

What does “whole of market” mean?

When dealing with a whole of market broker or independent mortgage broker, you will have access to the whole of the mortgage market. These brokers will trawl through the different lenders and deals to pick out the ones they feel best suit you.

Most brokers of this type will have access to around 90 lenders, including specialist lenders and banks.

What types of mortgage borrowers can a broker deal with?

Most mortgage brokers will be able to deal with a wide range of different types of borrower. This includes first-time buyers, home movers, holiday let investors and those looking to remortgage their property.

Why would anyone use a broker?

There are a number of reasons why you might choose to use a mortgage broker, including:

- You don’t have time to trawl through the different mortgage deals on the market.

- You’re not sure which type of mortgage is right for you.

- You’re not sure how much you can afford to borrow.

- You’re not sure what kind of deposit you’ll need.

A wide range of mortgage options

LOOKING AFTER YOUR BORROWING NEEDS

Buy to let

Competitive buy to let mortgages that include options for SPV borrowing, purchase, remortgage or capital raise.

Holiday Let

Specialist advice for UK holiday let mortgages including Furnished Holiday Lets, Airbnb and mixed use properties. Solutions for purchase, remortgage and develop.

Moving Home

Take the stress out of finding a moving home mortgage by letting our brokers arrange that for you.

Second Homes

A second home mortgage will allow you to purchase a UK holiday home for you and your family to enjoy.

Remortgages

Time to remortgage? Switch your mortgage to a new lender and grab yourself a new interest rate at the same time.

Right to Buy

If you are a local authority tenant and want to buy the property you’re living in using the Right to Buy scheme, we can help you find the best mortgage deal.

Guarantor / JBSP

If you are struggling to qualify for the mortgage you need, or don’t have enough deposit, then perhaps a guarantor mortgage could help.

First Time Buyer

All the help you need getting onto the property ladder and buying your first home. Including a cracking mortgage deal, sourced just for you.

Equity Release

An equity release lifetime mortgage can provide a tax-free lump sum or ongoing sums of money that you can spend however you wish.

Specialist Mortgages

Multiple streams of income, employment status, size of mortgage or perhaps an unusual property? Let’s get to work…

Mortgage Guides

Our mortgage guides will help you understand and compare different mortgage products whether you’re starting out, moving, remortgaging or buying to let.

Insurance

Making sure you, your home and your mortgage are protected against the unexpected.

Mortgage Calculators

Our easy to use mortgage calculators can help you at every stage of your mortgage journey. From working out what you could borrow to calculating the Stamp Duty.

SPV Mortgages

Rather than buying an investment property in their own name, many investors are now choosing to do this through a Special Purpose Vehicle limited company, or SPV.

Other areas covered: