Understanding your credit report can feel like trying to solve a puzzle with pieces from different boxes.

Each credit reference agency seems to speak its own language, with varying scores and mysterious calculations that can make even the most financially savvy person scratch their head.

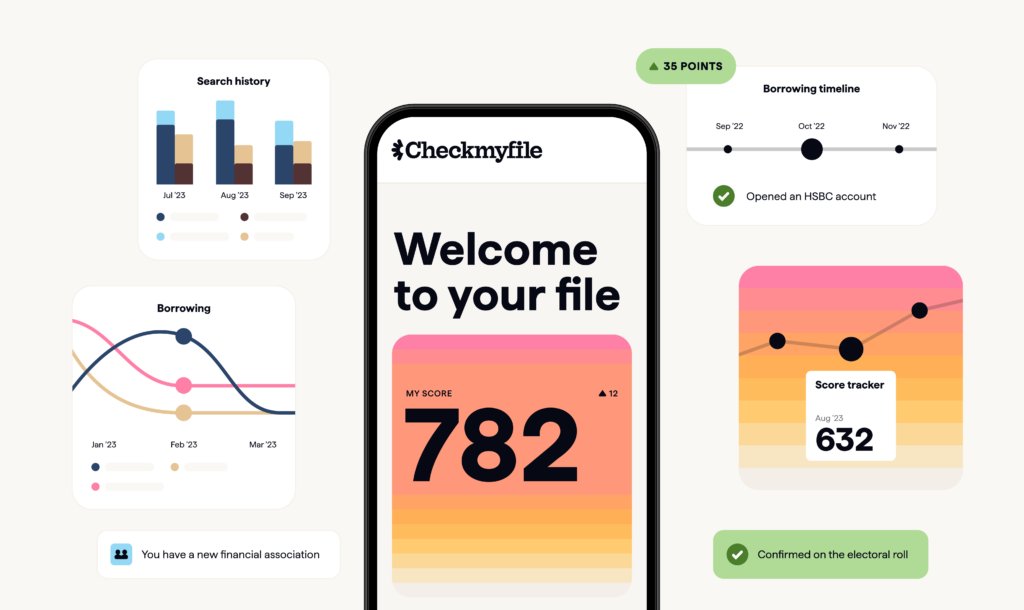

Checkmyfile offers a comprehensive solution to this credit reporting confusion.

By combining data from multiple UK credit reference agencies – Experian, Equifax, and TransUnion – Checkmyfile provides a crystal-clear picture of your financial standing.

More than just a report, Checkmyfile is your guide to understanding and improving your credit health.

Whether you’re a first-time buyer, looking to remortgage, or simply wanting to get a grip on your financial profile, this service cuts through the complexity and puts you in control.

By the end of this guide, you’ll understand exactly how Checkmyfile can help you unlock better financial opportunities.

What is Checkmyfile?

Credit reports can be a bit like looking at a landscape through different windows – each view slightly different, but none giving you the full scene.

With Checkmyfile you get the most detailed credit report on offer, containing data from three credit reference agencies.

The Multi-Agency Advantage

Imagine you’re applying for a mortgage and suddenly realise that each bank might be seeing a completely different version of your financial story.

That’s the reality of UK credit reporting.

Experian, Equifax, and TransUnion – the major credit reference agencies – don’t always tell the same story about your financial history.

Checkmyfile brings these agencies together in one comprehensive report.

It’s not just about collecting data; it’s about providing a 360-degree view of your credit profile.

By pulling information from all three major agencies you get the most complete picture possible of how lenders might view your creditworthiness.

Why Different Agencies Matter

In the mortgage market, lenders don’t all do the same thing.

Some might prioritise Experian’s data, while others lean heavily on Equifax or TransUnion. Each agency has its own scoring system – Experian ranges from 0-999, Equifax from 0-700, and TransUnion from 0-710.

Confusing? Absolutely.

This is where Checkmyfile helps.

Real-World Impact

Let’s break this down with a practical example.

Sarah, a first-time buyer in London, discovered through Checkmyfile that a missed phone bill payment appeared on her TransUnion report but wasn’t flagged on Experian. Without a multi-agency report, she might have missed this important detail that could impact her mortgage application.

Beyond Just Numbers

Checkmyfile doesn’t just throw numbers at you.

The service provides context, showing:

- Credit accounts

- Payment history

- Public records

- Financial associations

- Identity fraud warnings

The Broker’s Perspective

For mortgage brokers, this comprehensive approach is gold.

It allows for more accurate pre-application assessments, helping clients understand potential hurdles before they apply. You’re not just getting a credit report; you’re getting a strategic financial overview.

The beauty of Checkmyfile lies in its simplicity.

One report, three agencies, a complete picture of your financial health. It transforms complex credit data into actionable insights, giving you the confidence to move forward with your financial goals.

Related reading: What is a Credit Reference Agency?

How Checkmyfile Works: Unveiling Your Credit Story

Credit reporting isn’t magic – it’s a careful process of collecting, analysing, and presenting your financial history.

Checkmyfile has perfected this art, transforming complex data into a clear explanation of your financial journey.

The Data Collection Puzzle

Think of Checkmyfile as a financial detective, gathering clues from multiple sources.

It pulls information from three credit reference agencies: Experian, Equifax and TransUnion. Each agency collects data differently, creating a mosaic of your financial behaviour.

The information comes from various sources: banks, credit card companies, utility providers, and public records.

Every loan, credit card, mobile phone contract, and mortgage leaves a trace.

Missed a payment? Opened a new account? These details all contribute to your credit profile.

Cracking the Credit Score Code

Credit scoring isn’t a one-size-fits-all approach.

Checkmyfile uses a unique 0-1000 scale, combining insights from multiple agencies. But here’s the insider secret – it’s not just about the number.

The score considers:

- Payment history (your track record of paying bills on time)

- Credit utilisation (how much of your available credit you’re using)

- Length of credit history

- Types of credit accounts

- Recent credit applications

Regular Updates

Your credit report isn’t static – it’s a living document.

Checkmyfile updates monthly, capturing the latest changes in your financial status. Lenders report to credit agencies at different times, which means your report can reflect recent improvements or challenges quickly.

Credit Scores: What the Numbers Mean

- Excellent: 961-999

- Good: 881-960

- Fair: 721-880

- Poor: 300-720

- Excellent: 466-700

- Good: 420-465

- Fair: 380-419

- Poor: 300-379

- Excellent: 628-710

- Good: 604-627

- Fair: 566-603

- Poor: 300-565

The Broker’s Insider View

For mortgage brokers, Checkmyfile is like a crystal ball.

It helps identify potential barriers before a mortgage application is completed. A missed payment here, an unexpected financial association there – these details can make or break an application.

Brokers use this comprehensive report to:

- Prepare clients for potential challenges

- Suggest strategies to improve credit scores

- Match clients with the right lenders

Regulatory Compliance: Keeping it Legit

Checkmyfile operates under strict UK financial regulations.

The service ensures data protection, giving you peace of mind that your financial information is handled securely and transparently.

Understanding your credit report isn’t about perfection – it’s about progress. Checkmyfile gives you the tools to see where you are and map out where you want to be.

Related reading: What credit score is needed for a mortgage?

TRY CHECKMYFILE FREE FOR 30 DAYS

- See your data from 3 Credit Reference Agencies, not just 1

- Get an independent view with your checkmyfile Credit Score

- View up to 6 years’ credit history

- Easy to cancel – by Freephone or even online

- A guarantee never to sell your personal data

- Consistently rated ‘Excellent’ on Trustpilot

This is a 30-day free trial, and a recurring £14.99 thereafter unless the subscription is cancelled, which can be done at any-time.

Who Needs a Checkmyfile Report?

Checkmyfile is designed for anyone wanting to understand their credit situation.

First-Time Buyers: Your Financial Foundation

Picture Jack and Emma, a young couple in Bristol dreaming of their first home. They’re approaching the property market with excitement and a touch of uncertainty. For first-time buyers, Checkmyfile is like a financial compass.

Many young professionals don’t realise how seemingly small financial decisions can impact mortgage applications.

A missed phone bill, an unexpected overdraft, or a new credit card can all leave marks on your credit report. Checkmyfile helps you understand these nuances before they become a real problem.

Complex Credit Histories

Some financial journeys aren’t smooth sailing.

Perhaps you’ve:

- Recovered from a period of financial difficulty

- Experienced unexpected job loss

- Gone through a divorce affecting joint finances

- Dealt with identity fraud

Mark, a freelance graphic designer in Bury, discovered multiple discrepancies across different credit agencies after a challenging few years. Checkmyfile helped him identify and address these issues, giving him a clear path to financial recovery.

Mortgage Applicants: Your Pre-Application Ally

Whether you’re remortgaging or applying for your first home loan, understanding your credit report is essential. Lenders don’t just look at a single number – they examine your entire financial history.

Sarah, a teacher in Leeds, used Checkmyfile to prepare for her mortgage application. By identifying and addressing a forgotten mobile phone contract with a small outstanding balance, she improved her chances of approval.

Related: What Lenders Want To See On Your Credit Report

Rebuilding Credit: A Second Chance

Life throws curveballs.

Credit rebuilding isn’t about perfection – it’s about progress. Checkmyfile provides a detailed roadmap for those looking to improve their financial standing.

Life Stages and Credit Health

Your credit needs change as your life evolves:

- Graduates entering the job market

- Couples merging finances

- Parents planning for the future

- Individuals recovering from financial setbacks

Take Anna, who recently started her own business. Her credit report became an essential tool in securing business financing, showing potential lenders her financial responsibility.

Beyond the Basics

Checkmyfile isn’t just for those with credit challenges.

It’s for anyone who wants:

- A complete view of their financial health

- Early warning of potential issues

- Confidence in their financial decisions

Remember, your credit report is more than a score – it’s a reflection of your financial journey. Whether you’re taking your first steps or rebuilding after a challenging period, knowledge is your greatest asset.

Related reading: Will Checking My Credit Report Affect My Credit Score?

Alternatives to Checkmyfile

Credit reporting isn’t a one-size-fits-all solution, let Checkmyfile help you make the best choice for your financial journey.

The Credit Reporting Marketplace

There are several credit reporting players, each with their own strengths and limitations.

Let’s pull back the curtain on the main alternatives:

Experian

Strengths:

- Largest credit reference agency in the UK

- Detailed individual reports

- Free basic service available

Limitations:

- Only provides Experian’s perspective

- Can miss nuances from other agencies

ClearScore

Strengths:

- Free credit reports

- User-friendly interface

- Based on Equifax data

Limitations:

- Single agency view

- Focuses on marketing financial products

Credit Karma

Strengths:

- Free credit reports

- Uses TransUnion data

- Offers credit improvement suggestions

Limitations:

- Limited to one credit reference agency

- Heavily focused on product recommendations

Why Checkmyfile Stands Out

Where these alternatives offer a single view, Checkmyfile provides a panoramic view.

They cross-reference multiple sources, ensuring you’re not missing any details.

Key differentiators include:

- Multi-agency reporting

- No marketing of financial products

- Comprehensive credit health insights

- User-focused approach

When to Consider Specialised Reporting

Sarah, a mortgage broker in London, shares her professional perspective:

“Not every client needs the same level of detail. Sometimes, a basic report works, but for complex financial situations, Checkmyfile’s comprehensive approach is invaluable.”

Complementary Credit Improvement Strategies

Credit reporting isn’t just about checking a score – it’s about understanding and improving your financial health.

Brokers recommend:

- Regular monitoring

- Addressing discrepancies quickly

- Understanding factors affecting your score

- Strategic credit management

Making the Right Choice

Choosing a credit reporting service is personal.

Consider:

- Your specific financial goals

- Level of detail you need

- Budget for ongoing monitoring

- Complexity of your credit history

A quick chat with a mortgage broker can help you determine the most suitable approach for your unique circumstances.

A Word of Caution

While these alternatives offer insights, they’re not created equal. A multi-agency approach like Checkmyfile provides the most comprehensive view of your financial situation, all in one document.

Remember, your credit report is a living thing. It changes, grows, and reflects your financial journey.

The Checkmyfile Application Process

Getting started with Checkmyfile is straightforward, secure, and designed to give you the most comprehensive view of your credit health.

Signing Up: Your First Step

The process begins with a simple visit to the Checkmyfile website. You’ll start with a free 30-day trial – no commitment.

Here’s what you’ll need:

- Personal details (name, date of birth)

- Current and previous addresses

- Card details for verification (don’t worry, you won’t be charged during the trial)

Verification: Proving Your Identity

Security is paramount.

Checkmyfile will ask you a series of questions to confirm your identity.

These might include:

- Details of existing credit accounts

- Previous addresses

- Financial associations

Ensuring only you can access your sensitive information.

Your Report: What to Expect

Once verified, you’ll receive a comprehensive report detailing your credit situation. The report isn’t just a bunch of numbers – it’s a story told through data from three credit reference agencies.

Key Report Components to Explore

Credit Score Overview

This isn’t just a number – it’s a snapshot of your financial health. Checkmyfile presents a score from 0-1000, pulling insights from multiple agencies.

Payment History

Every credit card payment, loan repayment, and bill matters. This section shows your financial reliability at a glance.

Financial Associations

Spot any joint accounts or connections that might impact your credit standing. An ex-partner’s financial history could be affecting your score.

Red Flags to Watch For

Some elements to examine closely:

- Missed payments

- Unexpected credit applications

- Incorrect personal information

- Potential fraud indicators

Taking Action: Correcting Errors

Found something that doesn’t look right?

Here’s your action plan:

- Gather supporting documentation

- Contact the specific credit reference agency

- Raise a dispute with clear, concise evidence

- Follow up to ensure corrections are made

Read more: A Guide to Fixing Mistakes on Your Credit Report

Pro Tips from Mortgage Brokers

James, a senior mortgage broker, shares his advice:

“Don’t panic if you see something unexpected. Most credit report issues can be resolved with patience and proper documentation.”

Making the Most of Your Report

Your Checkmyfile report isn’t just a document.

Use it to:

- Understand your credit health

- Prepare for mortgage applications

- Identify areas for improvement

- Protect against potential fraud

Statutory Credit Reports

A statutory credit report is your official, legally protected access to credit information in the UK. Under the Consumer Credit Act, every UK citizen has the right to request a copy of their credit report for a small fee of £2.

You’ll receive a basic overview of your credit history, providing a snapshot of core financial details directly from the credit reference agency (CRA).

Obtaining Your Report

Getting your statutory report is simple. Contact each credit reference agency directly, provide proof of identity, pay the £2 fee, and receive your comprehensive credit record.

The key is to view your statutory report as a starting point. Combine it with more comprehensive services to get the full picture of your financial health.

Read more: Understanding Your Statutory Credit Report

Taking Action

Here’s how to turn insights into action.

Your Free Gateway to Financial Understanding

Checkmyfile offers a 30-day free trial that’s more than just a peek behind the curtain.

It’s your chance to:

- Explore a comprehensive multi-agency credit report

- Understand your financial standing

- Identify potential improvements

- Access expert insights

No strings attached. Just pure, transparent financial information.

Continued Credit Management: Your Ongoing Journey

Credit health isn’t a one off thing – it’s a continuous journey.

Practical steps include:

- Regular report monitoring

- Addressing any discrepancies quickly

- Understanding factors influencing your score

- Making consistent, reliable financial decisions

Your Financial Passport

Think of your credit report like a financial passport. It opens doors, creates opportunities, and tells your financial story. Checkmyfile provides the most comprehensive view, giving you control and confidence.

Taking Charge

Whether you’re:

- Planning to buy your first home

- Looking to remortgage

- Rebuilding your credit

- Simply wanting to understand your financial health

Checkmyfile offers a clear, detailed pathway forward.

Ready to Take the First Step?

Start your free 30-day trial.

Get The UK’S Most Detailed Online Credit Report

- See your data from 3 Credit Reference Agencies, not just 1

- Get an independent view with your checkmyfile Credit Score

- View up to 6 years’ credit history

- Easy to cancel – by Freephone or even online

- A guarantee never to sell your personal data

- Consistently rated ‘Excellent’ on Trustpilot

This is a 30-day free trial, and a recurring £14.99 thereafter unless the subscription is cancelled, which can be done at any-time.

Frequently Asked Questions

A credit report is a detailed record of your financial history over the last six years, showing how you’ve managed credit and financial commitments over time.

No, checking your own report is a ‘soft search‘ and does not impact your credit score.

Read more: Will Checking My Credit Report Affect My Credit Score?

Checkmyfile combines data from three credit reference agencies, providing a more comprehensive view than single-agency reports.

Yes, by making consistent on-time payments, reducing credit utilisation, and maintaining a stable financial history.

Contact the specific credit reference agency with evidence to dispute and correct the inaccuracy.

Soft searches are background checks that don’t affect your score, while hard searches by potential lenders can impact your rating.

Joint accounts create a financial association, meaning your partner’s credit history can influence your own.

Related: How to remove financial associations from your credit report