Mortgage Brokers in Harrow offer a wide range of services to help you get the best mortgage for your needs. They can help you compare mortgages from a variety of lenders, and they will work with you to find the best deal. They can also help you through the entire process, from application to completion and everything in between..

Harrow is located in Greater London, and it is one of the boroughs that make up the capital. It has a population of just over 300,000 people. The town is situated in the northwest of London, and it is a convenient and popular commuter town for those who work in the city.

What is a mortgage adviser?

A mortgage adviser is someone who is qualified to help you find the right mortgage for your specific needs and circumstances. They will assess your financial situation and offer advice on which products would suit you best

There are many different types of mortgages available, from fixed rate to variable rate, so it’s important to get expert advice to ensure you choose the right one for your needs. A mortgage adviser can also help you understand the different features of each type of mortgage and what would work best for you.

What types of mortgage borrowers can a broker deal with?

Most mortgage brokers are happy to work with a range of borrower types. This includes first-time buyers, home movers, re-mortgagers, buy to let landlords and those looking for a commercial mortgage.

They also deal with more specialist situations such as:

- Remortgaging with bad credit

- Securing a mortgage after a divorce

- Mortgages for the self-employed

- Mortgages for freelancers

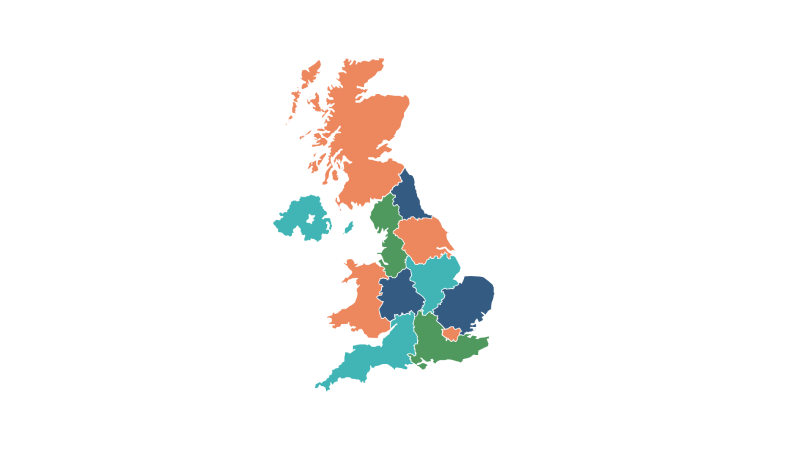

Respect Mortgages works with one of the largest and most respected independent mortgage brokers. They have been in business for over 45 years and have qualified advisers all over the UK, including Harrow and nearby Finchley, Ruislip and Pinner.

Why should anyone use a broker?

There are many reasons why someone might want to use a mortgage broker. Firstly, it can save you a lot of time and hassle as they will do all the hard work for you. They will also have access to a wider range of mortgage products from different lenders, so you’re more likely to find the perfect deal.

For many people their situation means that the usual high street lenders aren’t interested. Fortunately, brokers can search beyond the high street to find specialist banks and lenders who are more flexible.

Can I get a mortgage without using a broker?

It is possible to get a mortgage without using a broker, but it’s generally not advisable. This is because brokers have access to exclusive deals and rates that you wouldn’t be able to find if you went directly to a lender. They will also be able to give you impartial advice and guidance throughout the process.

Are all mortgage brokers the same?

No, all mortgage brokers are not the same. There are different types of broker, such as whole-of-market, direct-only and fee-based brokers. It’s important to choose the right type of broker for your needs.

Whole-of-market brokers have access to products from all lenders, so they can find the best deal for your circumstances.

Direct-only brokers can only offer products from a single lender, or perhaps a very small panel. This means they may not be able to find the best deal for you.

Do I have to meet face to face?

Most mortgage brokers are happy to deal with clients over the phone, by video or online. However, some may require you to meet face to face in order to assess your financial situation.

What does “whole of market” mean?

Whole of market simply means that the broker can offer products from all lenders, not just a select few. This gives you more choice and increases your chances of finding the perfect deal.

Do brokers need to have a special qualification?

All mortgage brokers must be qualified and regulated by the Financial Conduct Authority (FCA). This means they have undergone extensive training and are required to adhere to strict rules and regulations.

How do I find a good mortgage broker?

There are a few things you can do to find a good mortgage broker. Firstly, you could ask family and friends for recommendations. Alternatively, you could search online. Once you’ve found a few brokers, make sure to check their credentials and reviews before making your final decision.

A wide range of mortgage options

LOOKING AFTER YOUR BORROWING NEEDS

Buy to let

Competitive buy to let mortgages that include options for SPV borrowing, purchase, remortgage or capital raise.

Holiday Let

Specialist advice for UK holiday let mortgages including Furnished Holiday Lets, Airbnb and mixed use properties. Solutions for purchase, remortgage and develop.

Moving Home

Take the stress out of finding a moving home mortgage by letting our brokers arrange that for you.

Second Homes

A second home mortgage will allow you to purchase a UK holiday home for you and your family to enjoy.

Remortgages

Time to remortgage? Switch your mortgage to a new lender and grab yourself a new interest rate at the same time.

First Time Buyer

All the help you need getting onto the property ladder and buying your first home. Including a cracking mortgage deal, sourced just for you.

Equity Release

An equity release lifetime mortgage can provide a tax-free lump sum or ongoing sums of money that you can spend however you wish.

Specialist Mortgages

Multiple streams of income, employment status, size of mortgage or perhaps an unusual property? Let’s get to work…

Mortgage Guides

Our mortgage guides will help you understand and compare different mortgage products whether you’re starting out, moving, remortgaging or buying to let.

Insurance

Making sure you, your home and your mortgage are protected against the unexpected.

Mortgage Calculators

Our easy to use mortgage calculators can help you at every stage of your mortgage journey. From working out what you could borrow to calculating the Stamp Duty.

SPV Mortgages

Rather than buying an investment property in their own name, many investors are now choosing to do this through a Special Purpose Vehicle limited company, or SPV.

Other areas covered:

Some recent articles

How To Get An Unencumbered Mortgage

You no longer have a mortgage or have inherited a property, and now you’re hearing about “unencumbered mortgages” but feeling confused about what this actually means. Perhaps you need to …

Do I Need Critical Illness Insurance for My Mortgage?

You’re buying a home or remortgaging, and suddenly everyone’s talking about critical illness insurance. Your lender mentions it, your broker suggests it, and you’re left wondering if it’s actually required …

What’s the Difference Between a Secured and Unsecured Loan?

When looking at loans you have two main options: secured loans and unsecured loans. The difference between them is simple but important. A secured loan uses your property as a …

How Does a Secured Loan Work?

You need £50,000 for home improvements but the monthly personal loan repayments are making your eyes water. You’ve heard about secured loans but aren’t sure how the whole process actually …