What is a mortgage broker and what do they do

A mortgage broker is a professional who helps people find the best mortgage for their needs. They work with a variety of lenders, and can help you find the best interest rate, term, and other features of a mortgage. They can also help you through the process of getting a mortgage, from filling out paperwork to getting approved.

Bournemouth is a beautiful town on the south coast of England. It’s a popular tourist destination, with plenty of things to do and see. There’s easy access to the New Forest and the town of Ringwood.

If you’re thinking of moving to Bournemouth, or are already living there, you’ll need to find a mortgage broker who can help you find the best deal on your mortgage.

How to find a mortgage broker in Bournemouth

If you’re looking for a mortgage broker in Bournemouth or Dorset, there are a few things you can do to find the best one for you. First, ask around. Your friends and family may have used a Bournemouth based broker in the past, and they can recommend someone good. You can also search online for reviews of local brokers.

Respect Mortgages works with one of the largest and most respected independent mortgage brokers. They have been in business for over 45 years and have qualified advisers all over the UK, including Bournemouth and Poole.

The benefits of using an independent mortgage broker

When it comes to mortgages, there are a lot of options out there. This can be both good and bad – it’s good because you have a lot of choice, but it can also be confusing and difficult to figure out which one is right for you. This is where a mortgage broker comes in.

Mortgage brokers are experts in the field of mortgages, and they can help you find the best mortgage for your needs. They work with a variety of lenders, so they can find you the best interest rate and terms. They can also help you through the process of getting a mortgage, from filling out paperwork to getting approved.

There are many benefits to using a mortgage broker, but the three main ones are:

- They save you time

- They save you money

- They take the stress out of getting a mortgage

A wide range of mortgage options

LOOKING AFTER YOUR BORROWING NEEDS

Buy to let

Competitive buy to let mortgages that include options for SPV borrowing, purchase, remortgage or capital raise.

Holiday Let

Specialist advice for UK holiday let mortgages including Furnished Holiday Lets, Airbnb and mixed use properties. Solutions for purchase, remortgage and develop.

Moving Home

Take the stress out of finding a moving home mortgage by letting our brokers arrange that for you.

Second Homes

A second home mortgage will allow you to purchase a UK holiday home for you and your family to enjoy.

Remortgages

Time to remortgage? Switch your mortgage to a new lender and grab yourself a new interest rate at the same time.

First Time Buyer

All the help you need getting onto the property ladder and buying your first home. Including a cracking mortgage deal, sourced just for you.

Equity Release

An equity release lifetime mortgage can provide a tax-free lump sum or ongoing sums of money that you can spend however you wish.

Specialist Mortgages

Multiple streams of income, employment status, size of mortgage or perhaps an unusual property? Let’s get to work…

Mortgage Guides

Our mortgage guides will help you understand and compare different mortgage products whether you’re starting out, moving, remortgaging or buying to let.

Insurance

Making sure you, your home and your mortgage are protected against the unexpected.

Mortgage Calculators

Our easy to use mortgage calculators can help you at every stage of your mortgage journey. From working out what you could borrow to calculating the Stamp Duty.

SPV Mortgages

Rather than buying an investment property in their own name, many investors are now choosing to do this through a Special Purpose Vehicle limited company, or SPV.

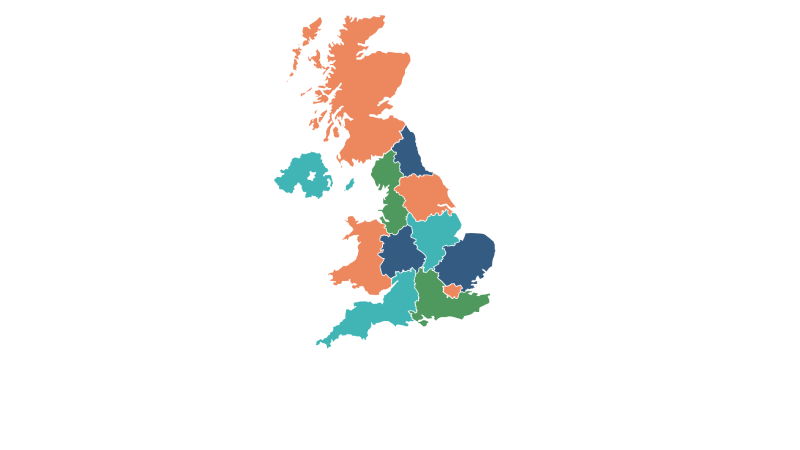

Other areas covered: