Energy Performance Certificates are legally required whenever you sell, rent, or build a property in the UK.

Understanding how EPCs work and what they mean for your property can help you avoid fines, improve your property’s value, and make better investment decisions.

Whether you’re a first-time buyer trying to understand what those colourful A-G ratings mean, a landlord facing new minimum energy standards, or a homeowner considering improvements, this guide covers everything you need to know about EPCs.

By the end of this guide, you’ll understand how EPCs affect your property and what steps you can take to ensure you’re compliant, competitive, and making the most of your investment.

energy performance certificates

What Is an Energy Performance Certificate?

An Energy Performance Certificate, or EPC, is essentially your property’s energy report card.

Just like the energy labels you see on washing machines or fridges, an EPC gives your home or building a rating from A (brilliant) to G (pretty awful) based on how energy efficient it is.

Think of it as a snapshot of how much it costs to heat, light, and power your property under normal circumstances.

The certificate also suggests practical ways to improve your energy efficiency and cut your bills.

When You Need an EPC

You’ll need an EPC whenever you’re building, selling, or renting out a property.

It’s been a legal requirement since 2007, and there’s no getting around it.

Estate agents can’t even start marketing your property without one. Landlords face hefty fines if they try to rent without a valid certificate.

Impact on Property Values

Your EPC rating will affect your property’s value and appeal.

A-rated homes sell for premium prices, while F and G-rated properties can be worth 10% less than their more efficient neighbours.

Buyers are increasingly savvy about energy costs, especially with recent price hikes making efficiency a real selling point.

Understanding the Rating System

The rating system is straightforward enough.

An A-rated property is the gold standard – think ultra-modern eco-homes with solar panels, heat pumps, and top-notch insulation. These properties typically cost just £200-400 per year to run.

At the other end, G-rated properties are energy guzzlers that might cost you £2,000+ annually in energy bills. Most UK homes currently sit somewhere in the middle, around Band D, with annual energy costs of roughly £900-1,200.

What You Get with Your EPC

The EPC gives you your overall property rating and also a recommendations report, with practical advice on improvements that could boost the rating.

You might see suggestions for cavity wall insulation, a new boiler, or LED lighting throughout. Each recommendation includes estimated costs and potential savings, helping you prioritise which improvements offer the best return.

For landlords, EPCs have become particularly important.

You can’t legally rent out a property with an F or G rating anymore. The minimum standard is currently Band E, but that’s set to tighten significantly. By 2028, most rental properties will need to achieve Band C, with Band B potentially required by 2030.

Properties with better EPC ratings attract tenants more easily, command higher rents, and face fewer void periods. They’re also becoming essential for accessing green mortgages and other sustainable finance products.

Get an Instant EPC Quote

The UK’s largest EPC provider. Rated Excellent by Trustpilot.

Residential and commercial Energy Performance Certificates – NATIONWIDE SERVICE

Understanding EPC Ratings

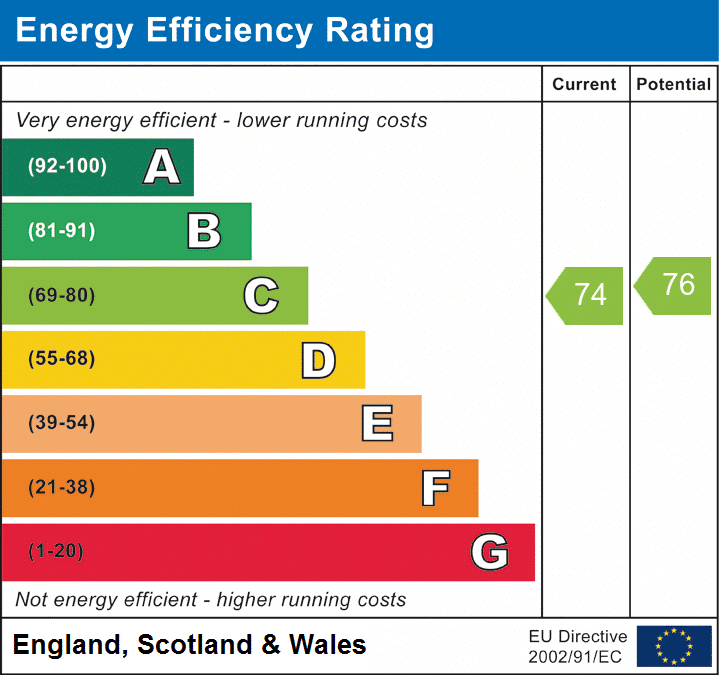

EPC ratings work on a simple A to G scale, with A being the most energy efficient and G the least.

The ratings are also colour coded; A is dark green, B is light green, C is yellow, and so on down to G in red. It’s designed to be instantly recognisable, much like traffic lights.

Each rating corresponds to a Standard Assessment Procedure (SAP) score, which runs from 1 to over 100.

The higher the number, the more efficient your property. A Band A property scores 92 or above, while a Band G property typically scores between 1 and 20.

Most UK homes fall into the D or E categories, with SAP scores between 39 and 68.

Band A

A Band A property is the cream of the crop – usually a new build or extensively renovated home with features like solar panels, ground source heat pumps, and excellent insulation throughout.

Annual energy costs typically run between £200-400. These properties are rare in the UK housing stock, making up less than 1% of homes.

Band B and C

Band B properties are still excellent performers, usually costing £400-600 annually to heat and power. You’ll find modern homes built to high energy standards, or older properties that have been comprehensively improved.

Band C properties, costing around £600-900 per year, represent good energy efficiency and are increasingly the target standard for rental properties.

Band D

Band D is where most UK homes currently sit.

Built mainly between the 1980s and 2000s, these properties typically cost £900-1,200 annually to run. They usually have some insulation and reasonably efficient heating systems, but there’s definite room for improvement. This is the current UK average, but it’s gradually improving as more properties are upgraded.

Band E

Band E properties cost around £1,200-1,600 per year for heat and power. This is currently the minimum standard for rental properties, but many homes in this category are older properties from the 1960s-80s with limited insulation and less efficient heating systems.

While still legal to rent, these properties are becoming less attractive to tenants concerned about energy costs.

Bands F and G

With annual energy costs often exceeding £1,600-2,000+, these properties are expensive to live in and impossible to rent legally.

They’re typically older homes with solid walls, single glazing, and outdated heating systems. Properties in these categories often struggle to sell and definitely can’t be let without significant improvements.

What Rating to Expect by Property Age

The age of your property gives a good indication of its likely rating.

Homes built before 1920 often need substantial work to achieve even Band E. Properties from the 1920s-1960s typically fall into bands D-F depending on improvements made.

Homes from the 1970s-1990s usually achieve D or E ratings, while anything built after 2000 is likely to be C or better, especially if it meets current building standards.

A Band C property might cost more upfront, but the lower running costs and better rental prospects often make it worthwhile.

When Do You Need an EPC?

You’ll need an EPC in three main situations:

- when you’re selling a property

- renting it out

- or building a new one

Selling Your Property

If you’re selling your home, you must have a valid EPC available from the moment you start marketing the property.

Your estate agent will often sort this out for you, but ultimately it’s your responsibility as the seller. The certificate needs to be available to potential buyers straight away – you can’t wait until someone makes an offer.

Most agents won’t even list your property without seeing the EPC first. The penalty for selling without an EPC is a fine of up to £200, but the bigger problem is that you simply can’t complete the sale legally without one.

Rental Properties: Stricter Rules

For rental properties, the rules are tougher and getting tougher still. Right now, you cannot legally let a property with an EPC rating below Band E.

This applies to all private rental properties, whether you’re letting to a family or running a house in multiple occupation (HMO). The penalty for non-compliance can be as much as £5,000, and local authorities are increasingly active in enforcement.

The government has announced plans to raise the minimum standard to Band C by 2028 for all rental properties, with Band B potentially required by 2030.

New Builds and Commercial

New build properties need an EPC as well, but the responsibility lies with the builder or developer. They must provide you with the certificate within five days of completing construction.

Most new builds achieve Band A or B ratings due to current building regulations.

Commercial properties follow similar rules but with additional requirements. If your commercial building has a floor area over 500 square metres and is frequently visited by the public, you must display the EPC prominently within the building.

Future Changes for Landlords

There’s a significant change coming around EPC validity for rentals. Currently, you need a valid EPC when you first let the property, and it lasts for 10 years.

The government is consulting on requiring landlords to maintain a valid EPC throughout the entire tenancy period.

Combined with proposals to reduce EPC validity from 10 years to 5 years, this means much more frequent assessments and higher ongoing costs.

How to Get an EPC and What It Costs

Getting an EPC isn’t complicated, but you need to make sure you’re using the right person for the job.

Only accredited energy assessors can produce legally valid EPCs, and using an unqualified assessor will leave you with a worthless piece of paper and potential legal problems.

Finding the Right Assessor

For domestic properties like houses and flats, you need a Domestic Energy Assessor (DEA).

For commercial buildings, you’ll need a Non-Domestic Energy Assessor (NDEA), who requires more advanced qualifications. Both types of assessor must be registered with a government-approved accreditation scheme.

The easiest way to find a qualified assessor is through the government’s official register at www.gov.uk. Simply enter your postcode, and you’ll get a list of accredited assessors in your area. Don’t be tempted to use anyone who isn’t on this list – it’s not worth the risk.

What It Costs

Costs vary depending on your property type and location, but you can expect to pay between £60-120 for a domestic EPC.

Smaller flats at the lower end, larger houses at the upper end. In London and the South East, prices tend to be higher – sometimes £100-150 for a typical family home.

Commercial EPCs are significantly more expensive, ranging from £300 for simple buildings up to £1,500+ for complex properties.

Several factors affect the price:

- Rush jobs cost more

- Remote locations might cost extra

- Property size and complexity

The Assessment Process

The assessor will arrange to visit your property at a convenient time.

The process is completely non-invasive, there’s no damage to your home.

For a typical house, the assessment takes 60 minutes, though larger or more complex properties might take longer.

What You Receive

Once the assessment is complete, you’ll usually receive your EPC within 24-48 hours by email.

The certificate will be uploaded to the government’s EPC register, where it remains publicly searchable for the full 10-year validity period.

You’ll get the official certificate plus a recommendations report suggesting improvements and their potential costs and savings.

Get an Instant EPC Quote

The UK’s largest EPC provider. Rated Excellent by Trustpilot.

Residential and commercial Energy Performance Certificates – NATIONWIDE SERVICE

EPC Requirements for Rental Properties

If you’re a property investor or landlord, EPCs are essential, they’re about keeping your properties legally lettable and financially viable.

The rules have tightened dramatically in recent years, and they’re set to get much stricter.

Current Minimum Standards

Right now, you cannot legally rent out any property with an EPC rating below Band E.

This rule applies to all privately rented residential properties in England and Wales, whether you’re letting a single house or managing multiple HMOs.

There are no exceptions for older properties or special circumstances – Band E is the absolute minimum.

Local authorities can fine landlords for renting out properties that don’t meet the minimum energy efficiency standards (MEES).

Band C by 2028

The standards are rising fast. The government has announced that new tenancies will need to meet Band C from 2025, with all existing tenancies required to reach Band C by 2028.

There are also proposals for Band B to become the minimum by 2030.

This timeline might seem generous, but moving from Band E to Band C requires significant investment – new boilers, insulation upgrades, window replacements, or heating system overhauls.

The government recognises that improvements cost money, so there’s a cost cap system in place. If you’ve spent the capped amount but still can’t reach Band E, you can register an exemption.

HMO and Holiday Let

For HMO landlords, the rules apply to the whole building if it’s let as separate units with shared facilities. You don’t need individual EPCs for each room, but the property as a whole must meet the minimum standard.

Holiday lets currently enjoy some exemptions if they’re rented for less than four months per year. However, proposals are afoot to bring short-term lets within the MEES regulations too.

How to Improve Your EPC Rating

Improving your EPC rating means reducing energy bills, increasing property value, and making your home more comfortable.

The good news is that many improvements are more affordable than you might think, and some offer quick wins that can boost your rating without major disruption.

Quick Wins: Low Cost, High Impact

Start with the easy wins that cost relatively little but can make a measurable difference. Replacing all your light bulbs with LEDs throughout the house typically costs £50-100 but will improve your EPC score and cut electricity bills immediately.

Draught-proofing is another quick win.

Sealing gaps around windows, doors, and other openings costs very little but can noticeably improve your home’s thermal efficiency. You can buy draught-proofing materials from any DIY store for under £50 and install them yourself in a weekend.

Installing a programmable thermostat or upgrading to smart heating controls can also boost your rating while giving you better control over your energy use. These typically cost £100-300 but can improve your EPC score and reduce heating bills.

Insulation: The Best Value Improvement

For bigger improvements, insulation is usually the most cost-effective option.

Loft insulation is often the cheapest per unit of energy saved. If you have no loft insulation or less than 100mm, topping up to 270mm typically costs £300-500 and can improve your EPC rating by one or even two bands.

Cavity wall insulation is another excellent investment if your property has unfilled cavities.

The work typically costs £500-1,500 depending on property size, but it can dramatically reduce heat loss and improve your EPC rating significantly. Most properties built between 1920-1990 have cavity walls that can be insulated.

Heating System Upgrades

Upgrading your boiler can have a major impact on your EPC rating, especially if your current boiler is old and inefficient.

Modern condensing boilers are much more efficient than older models. A new A-rated boiler typically costs £2,000-4,000 installed, but it can improve your EPC rating by 1-2 bands while also reducing heating bills.

For properties that need major improvements to reach good EPC ratings, heat pumps are increasingly worth considering.

Air source heat pumps can achieve excellent efficiency ratings and may attract government grants. However, they work best in well-insulated properties and typically require radiator upgrades too.

Windows and Renewable Energy

Windows are a significant source of heat loss, particularly in older properties with single glazing. Double glazing can improve your EPC rating, though it’s a substantial investment – typically £5,000-8,000+ for a whole house.

Solar panels can significantly boost your EPC rating by generating renewable electricity. A typical domestic solar installation costs £4,000-8,000 but can improve your rating while reducing electricity bills and potentially providing income through the Smart Export Guarantee.

Property Survey Guide

Mortgage valuation or homebuyers report? Our guide explains what the different types of surveys are and how they work.

Types of Houses

Our guide covers the different types of homes, from studio flats to detached houses, and everything in between.

Mortgage Broker Guide

In this guide we’ll take a look at what mortgage brokers do, how they can help you, how they get paid plus tips on how to find a good one.

EPC and Mortgage Applications

The relationship between EPCs and mortgages is evolving rapidly, with energy efficiency becoming an increasingly important factor in lending decisions.

While most lenders won’t reject a mortgage application purely based on EPC ratings, they’re paying much more attention to energy efficiency than they used to.

Current Lender Practices

Currently, most mainstream mortgage lenders don’t have specific EPC requirements for standard residential mortgages.

However, this is changing as lenders become more aware of climate risks and regulatory expectations around sustainable lending. Some lenders are starting to ask surveyors to comment on energy efficiency in their valuation reports.

The bigger impact is in property valuations.

Surveyors are increasingly noting when properties have poor energy efficiency or will require significant improvements to meet rental standards. This can affect the surveyor’s valuation, which in turn affects how much you can borrow.

Green Mortgages

Green mortgages are where EPC requirements are most explicit.

These products offer reduced interest rates or cashback for energy-efficient properties, typically requiring minimum EPC ratings of B or C.

Barclays, NatWest, Santander, and several other lenders offer green mortgage products with specific energy performance criteria.

The benefits can be substantial.

Green mortgages might offer interest rate reductions of 0.1-0.5%, which can save thousands of pounds over the mortgage term. Some also provide cashback of £500-2,000 that can be used for further energy efficiency improvements.

However, always compare these terms to ‘non-green’ mortgage deals.

Buy-to-Let Considerations

For buy-to-let mortgages, EPC considerations are becoming more important.

Lenders are increasingly aware that properties below minimum energy efficiency standards can’t be legally let, making them potentially worthless as rental investments. Some BTL lenders now ask specifically about EPC ratings and future compliance plans.

If you’re buying a property with a poor EPC rating, some lenders might impose conditions requiring improvements before completion or within a specified timeframe.

This is particularly common with properties rated F or G, which can’t be rented legally without major improvements.

Get an Instant EPC Quote

The UK’s largest EPC provider. Rated Excellent by Trustpilot.

Residential and commercial Energy Performance Certificates – NATIONWIDE SERVICE

Future Changes

The EPC system is undergoing its biggest shake-up since introduction, with major changes planned that will affect every property owner.

Understanding these changes now helps you prepare for what’s coming and avoid nasty surprises.

New Calculation Methods

The most significant change is the introduction of a new calculation methodology called the Home Energy Model (HEM), which will replace the current Standard Assessment Procedure (SAP) for domestic properties.

Under the new system, domestic EPCs will include four headline metrics instead of the current single rating.

These will cover:

- fabric performance (how well your home retains heat)

- heating system efficiency and environmental impact

- smart readiness (potential for integrating smart technologies)

- energy costs

The changes are planned for implementation in the second half of 2026, though pilot schemes may start earlier. Existing EPCs will remain valid until their normal expiry dates, but new assessments will use the updated methodology.

Shorter Validity Periods

EPC validity periods are also set to change.

The current 10-year validity is likely to be reduced to 5 years, meaning more frequent assessments and higher ongoing costs for property owners. This change is driven by government desire for more up-to-date energy performance data and to encourage continuous improvement.

For rental properties, the proposed changes are even more significant.

The government wants to require valid EPCs throughout entire tenancy periods, not just when tenancies begin.

Combined with shorter validity periods, this means landlords will need to budget for much more frequent EPC renewals.

Expanding Requirements

The scope of EPC requirements is expanding as well.

Currently exempt property types like holiday lets and short-term accommodation will be be brought within the system.

Even listed buildings, which currently enjoy conditional exemptions, may eventually need EPCs, though special provisions might apply.

Smart Technology Integration

Smart meter integration represents another major change.

Future EPCs may incorporate real-time energy consumption data from smart meters, making assessments more accurate and dynamic. This could transform EPCs from static snapshots into continuously updated performance measures.

Preparing for Change

These changes are part of the government’s broader push towards net-zero emissions by 2050.

Buildings account for nearly 40% of UK carbon emissions, so improving their performance is essential for meeting climate targets.

For property owners, the message is clear: energy efficiency is becoming more important, not less. Properties that meet high efficiency standards now will be better positioned for future regulatory changes.

Those that don’t may face increasing compliance costs, reduced marketability, and potentially significant improvement expenses.

The smart approach is to start planning now. Consider which improvements would benefit your property most, research available grants and green financing options, and factor energy efficiency into your property investment decisions.

This guide provides general information about Energy Performance Certificates and is correct at the time of publishing. Regulations and requirements can change, so always check current government guidance and seek professional advice for your specific situation.